Independent optical businesses can rarely afford to purchase equipment outright for their practice, consulting room or glazing lab.

Instead, several finance options exist to help acquire the latest kit, which can cost anything up to £100,000 depending on the make and model.

Latest fundus cameras, autorefractors, tonometers, digital test charts, topographers, keratometers, lasers, combi units, blocking and edging equipment all require significant investment, but it is the acquisition of an OCT imaging system that needs most attention.

Costing the equivalent of a sports car, practice owners must be sure of a return on investment, which is often driven by an older patient demographic and availability of schemes such as minor eye care services.

Specsavers partners found out last month each store would be offering OCT technology, up from 35 to 740 practices across the country. Partners know they have to spend big on the equipment, despite the mega deal Specsavers’ owners will hope to secure through the bulk order.

For independent practitioners, the cost is even more daunting, but given the right application and patient footfall they can rest assured that possessing an OCT should be a profitable venture.

Specsavers’ huge investment in OCT follows concerted efforts to train its staff in minor eye conditions, and sees the multiple enter a space traditionally occupied by independents.

‘This is simply the right thing to do in terms of offering our patients a choice of the best possible technology in their eye examination.

‘It is another major step forward in our journey to transform eye health, putting hospital-grade equipment in the community and helping to close the gap between optometry and ophthalmology,’ Specsavers co-founder and optometrist, Doug Perkins, said at the time.

The developments are a fly in the ointment for some independents who offer OCT as a point of differentiation, while those who do not may now be forced to buy an OCT just to compete. Any such spike in interest can only be positive news for OCT manufacturers and finance providers.

Making it cost-effective

Finance providers step in to make the OCT purchase easier to manage, most commonly through hire purchase or leasing agreements.

For example, Performance Finance was established in 2005 to assist healthcare professionals including opticians.

The Kettering-based firm has 18 employees and lent business more than £50m last year, with the option for practice owners to take a lease, long funding lease, hire purchase and/or loan.

Stuart Burn (pictured left), managing director of Performance Finance, tells Optician prices for an OCT range from £25,000 to £100,000. Typically, £30,000 to £40,000 was the most common price range depending on manufacturer and specification.

He says: ‘I would say any practice at all [should look to purchase an OCT] as the clinical benefits are proven and well documented. From a return on investment point of view, a practice testing fully three days a week or more should probably take a serious look at OCT. Less than this and an OCT is unlikely to be cost-effective.

‘Obviously the more you test the more return is likely. However, we provide a fantastic return on investment (ROI) tool where you can alter the patient charge and volume to give you a great idea of how to maximise your income.

‘There is also the question of an OCT scan for all patients along with a slightly higher charge for the uplifted sight test. Again, our ROI tool will help solve these questions.

‘While the ROI tool is very effective I believe building OCT into the fabric of the practice is just as important. Our team often have lengthy conversations with our clients over how OCT will fit into their practice.’

Conversations should include the amount of space in practice, patient demographic, local competition, clinical need, possible hospital referrals and buy in from staff. ‘There’s a lot to think about and work through to ensure the best “fit” for your practice,’ adds Burn.

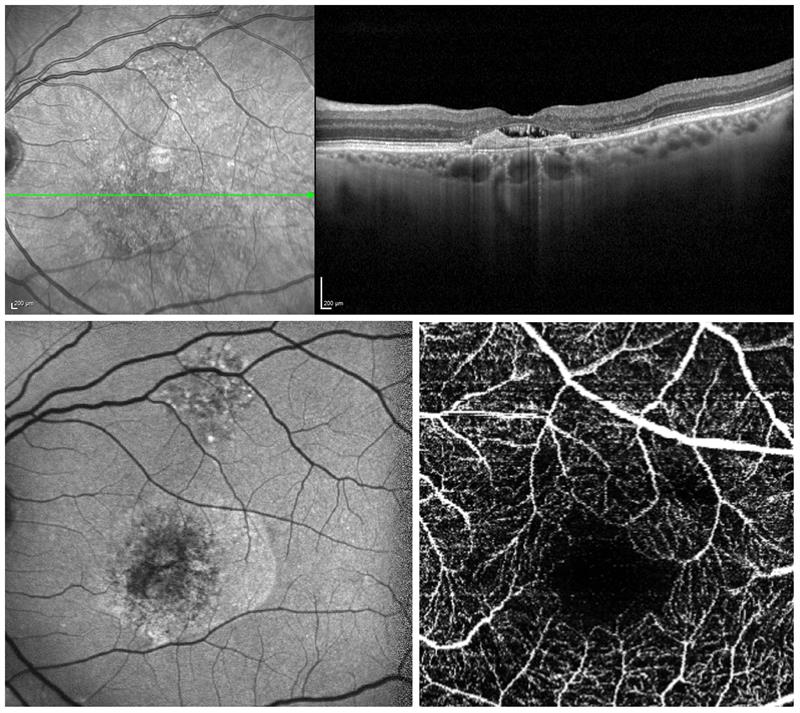

OCT imaging

What will be reassuring to the practitioner is Performance Finance reporting no demand from practices for help to sell on their equipment when they want to upgrade. Instead, Burn says most suppliers are willing to take in part exchanges for those wanting to upgrade, while there is also an established second hand market with dealers.

To buy or to lease

Just as with buying a vehicle, practitioners looking to buy an OCT must first choose between leasing and buying outright, either with cash or by borrowing.

Meanwhile, making the investment in OCT technology should result in a reduced corporation tax bill. As explained by specialist optical accountant Marc Bennett (Optician 28.04.17), expenditure may be allowable against taxable profit within the practice’s Annual Investment Allowance costing up to £200,000 per year. However, for a lease purchase, when the practice is effectively renting the equipment, corporation tax relief will only be available for the rentals falling due within an accounting period.

Supplier Braemar Finance, part of Close Brothers Group, tells Optician it offers ‘bespoke’ finance facilities to suit a particular business, taking into consideration the individual tax and VAT de minimis status, ‘ensuring that the facility chosen offers the most tax efficient method of acquiring new equipment’.

HMRC states that an amount that is insignificant is known as ‘de minimis’ and is set out in law for partial exemption purposes.

David Foster (pictured right), managing director of Braemar Finance, adds: ‘Costs of an OCT is determined by the suppliers, so therefore instalments vary dependant on what the offers may be current. A supplier may offer a deferred payment or low start deal.

Alternatively, we can accommodate the businesses by making the payments manageable for them by spreading the cost over a term to suit individual circumstances.

‘We work closely with many well-known suppliers and if a new supplier came onto the scene we would welcome them to use our facilities for their customers.’

Braemar Finance has 33 employees including a support team based in Dundonald, Scotland.

It has worked with sole traders, small corporates and major retailers, having supplied Specsavers in the past and expecting to do so again ahead of the multiple’s nationwide rollout.

Foster believes forward looking practices should be considering investments in retinal imaging equipment such as OCT.

He adds: ‘Any practice that has ambition and wishes to offer a range of treatments should be at the forefront of the digital technological advancement within the industry.

To get their money’s worth, Foster says optical businesses have a duty to train their team to fully understand how the new equipment works, and know how to sell its benefits and advantages to the patient.

He adds: ‘Utilising the OCT and the fee they charge can be demonstrated as to how quickly they can reap the benefits to the business, making the initial outlay cost effective when they see an increase in their cash flow and uptake of additional treatments.’

‘It’s a great piece of kit’

In terms of return on investment, he tells Optician uptake has been higher than expected, in line with the research he had undertaken before deciding to lease the Topcon Maestro 3D OCT.

‘The process was seamless,’ Oberai says. ‘Independents need to identify their USP and add value to the client. An OCT is just one piece of the puzzle and is not the main factor in determining if an independent practice will survive.’