Much is made of the increasing presence of online retailing in optics. And rightly so. According to a market research report by IBISWorld, over the five years to 2019, revenue from online sales of glasses and contact lenses grew at an annual compound rate of more than 6% and revenue in 2019 was more than £260m.

Over the years Optician has catalogued and studied the rise of online eyewear retailers, assessing their competition to the UK high street chains and analysing their rise in terms of business performance and market reach.

Now, a report by digital marketing company Salience has revealed where industry leaders sit in terms of visibility within the online eyewear market through a year on year comparison between competitors. Its original release included only 51 online eyewear retailers but, after Optician reached out for more information, it provided data on how all the major UK chains were performing.

Online challenges

The 2018 IBISWorld report said the online retail industry had faced strong competition from large, established bricks-and-mortar outlets. ‘High street opticians and supermarkets have expanded their eyewear businesses online and encroached on the online glasses and contact lens retailing industry,’ said the report.

‘Despite intense competition, online-only retailers have held their own over the past five years. Many have pursued technology innovations to remedy the fact that customers cannot try on products they are buying online.

‘A wider range of consumers are expected to purchase items from online opticians over the next five years,’ it added.

Measures to make online retailing more appealing have taken off in recent years, not least through virtual try on technologies, and a lot of energy has been invested by online retailers to improve distribution and customer service. The Salience report mapped each optician’s online domain, comparing figures from 2018 with 2019. It also situated these figures within wider market trends.

‘A domain may have increased visibility year-on-year, but if the market has grown by a greater margin, has there been an opportunity lost?’ asked the report.

Online visibility

Salience produced a list of ‘winners’ and ‘losers’ in the eyewear retailer industry by assigning each company an online visibility score (OVS) – how visible a website is in a search engine’s organic results – that provides a universal index for measuring and comparing the online performance of different domains.

This score was produced by SEO marketing firm Searchmetrics, who based it on ‘information on the search volume of relevant keywords and the ranking positions and frequencies of a domain’s URLs,’ explained Searchmetrics.

‘This means how often, and where the URLs rank for these keywords in the organic search results of Google, Bing, and other search engines,’ it said. ‘Each position is given an individual weighting in line with the methodology developed by Searchmetrics. Other data from dynamic models for calculating the Click-Through-Rate (CTR) also contributes to the calculation.’

All in all, the OVS of a domain will be greater if: the domain’s URLs rank higher up the search results list; different URLs on the domain are included in Google’s index with good rankings; the domain’s URLs rank well for keywords with a high search volume, according to Searchmetrics.

Many of you will know about SEO and its importance. Optician marketing manager Julian Halse explained just how vital it can be: ‘SEO stands for search engine optimisation. It allows people to search certain key words (pertaining to your industry) through online search engines. The more relevant your SEO is on your page the higher ranking your page.

For instance, if you are an optician, using keywords such as optics, lenses and glasses all help to increase your visibility on search engines.

‘Online search is how most customers will find your business in today’s market. Google is the modern day high street – not appearing there often means lower footfall and fewer sales.’

When Optician asked about the reliability of the OVS, Salience founder and director Richard Waters said the score was ‘as accurate as it can be when looking market wide’ and that ‘it’s a benchmarking metric intended to present a picture of how well the site is performing based on a large data set’.

The winners identified by Salience were determined not by the percentage growth in their OVS, but by the aggregate growth in that score – this helped to exclude small online retailers who have increased their OVS by a significant proportion from April 2018, possibly due to recent entry into the market, but who still had very low overall scores compared to others.

According to the Salience report, the ‘winners’ included: Vision Express, who had increased its OVS from 6,740 to 10,048; Ace and Tate Eyewear scored 1,813, compared with 450 in 2018; Misterspex, one of the most well-known online retailers, attained a OVS of 2,948, up from 1,643 last year; Fashion Eyewear went from 2,581 to 3,766 this year; and, finally, Optical Express increased its score from 3,226 last year to 3,733.

It is important to note that Specsavers received by far the highest total OVS, 21,543, meaning it was the most visible through organic searches, but this was down from 23,703 the previous year. This was why it was classified as a ‘loser’ by the Salience report, even if it does dominate the online eyewear retailers market – the nearest direct opticians-only competitor, Vision Express, had a score of less than half of Specsavers’.

Data concerning the other multiples was provided by Salience but was not included in the original report. Because Boots, Asda and Costco operate across other industries – their optician departments are only one part of their portfolios – their OVS was far greater than even Specsavers, reaching over 170,000 for Asda, 80,000 for Boots and 24,000 for Costco. However, these had all fallen on last year’s numbers.

Moreover, Salience said that top level domain data, such as Boots or Asda.com, said little about the online visibility of their optical departments as it was concerned with the domain as a whole.

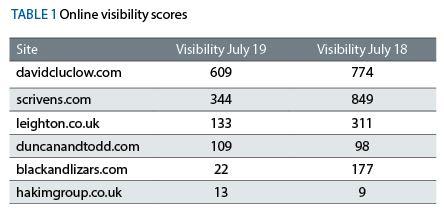

Aside from this, the other multiples in the UK fell well short of the levels of visibility achieved by the six previously mentioned. See table 1 for reference.

Interestingly, Salience identified a number of internet trends pertinent to the eyewear sector. Waters explained: ‘Google periodically releases updates to its ranking algorithm; these can often see big swings in performance for major players.

‘As the updates go, we’re seeing Google place more emphasis on solid technical foundations; depth of content that follows the customer purchasing journey and great user-ability. The days of gaming Google are gone, we need to think more about the customer.’

Addressing visibility

The importance of online visibility for online-only opticians is obvious but their business is being ‘encroached on’ by bricks-and-mortar outlets. What measures and tactics do the multiples, who will have large teams managing online presence, employ when it comes to increasing their online presence?

Digital brand manager at Vision Express, who scored well in the Salience report, Charlie Phair said: ‘We use a broad range of tools to continuously monitor all activity on and off our website. In most ways, digital does make a lot of our activity and campaigns far more transparent in terms of measuring performance and engagement, but online visibility has always been notoriously difficult to track in a real sense.

‘We stay ahead of the latest algorithmic updates from Google, and in the last year alone there have been two major updates that have directly impacted websites in the health sector.’

Phair also noted that optics had been slightly insulated from the pressures of online retailing as ‘it relies so much on the process within bricks-and-mortar stores’.

‘The digital future for opticians is an exciting prospect and one as a channel we are constantly looking to innovate and improve,’ added Phair.

Some other opticians may find the transformation less ‘exciting’ as SEO optimisation and online visibility is heavily dependent on Google and other search engines’ rankings. Large multiples have the labour and resources to exploit this effectively, while smaller opticians might not.

Nonetheless, with the technological changes under way within the sector, no business can afford to neglect its online presence.