With a population approximately 8% the size of Great Britain’s, but contact lens sales volumes of only around 3% of Great Britain’s, the Republic of Ireland is a contact lens market with the potential for strong growth. This piece compares the contact lens markets development over the past year across both countries.

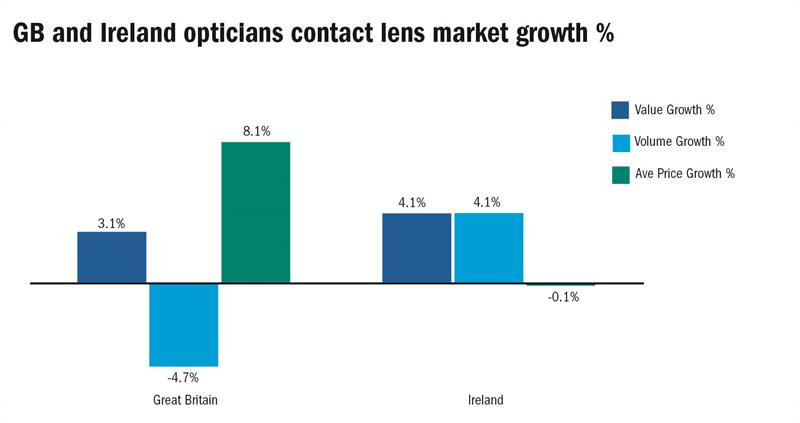

Growth in the contact lens markets across Great Britain and the Republic of Ireland have tended to occur in a similar manner with annual growth rates within a few per cent of each other across both countries over recent years. Over the year to June 2017 the Republic of Ireland has achieved growth in value sales compared to the previous year of +4.1%, slightly ahead of the growth rate achieved in Great Britain of +3.1%. This then appears to show a continuation of the status quo of relatively similar market performance, however, when we delve a little deeper to see how this value growth has been achieved we see a significant divergence in trends has developed.

In Great Britain monthly equivalent volumes (the total number of months’ worth of contact lens wear sold across different lens replacement frequencies) has declined by -4.7% over the past year. The value growth of +3.1% has been achieved by an average price increase of +8.1%. This trend has occurred as contact lens wearers in Great Britain have increasingly switched to daily lenses, costing more on average for an equivalent length of wear time compared to reusable lenses, and also allowing patients to save lenses on days which they may skip wearing their lenses altogether. This trend explains both the increase in average price and also the decline in total volumes sold as, while a monthly patient would require one pair of lenses per month irrespective of the number of days they are worn, a daily patient may only require 20 pairs per month if they are not wearing contact lenses on 10 days per month.

Conversely in the Republic of Ireland the value growth achieved has been driven by a +4.1% increase in monthly equivalent volume sales over the past year. Average prices have remained consistent – declining marginally by -0.1% over the same period. Coinciding with this we see that the transition to daily lenses in the Republic of Ireland has occurred significantly more slowly over the past year than in Great Britain. In the Republic of Ireland daily lenses gained an additional 1.6% points of monthly equivalent volume sales from reusables while in Great Britain this figure was significantly higher over the equivalent time at an additional 4.3% points.

However, this is not to suggest that the Republic of Ireland is lagging behind this trend generally – in fact the opposite is true. A greater proportion, and over half, of contact lens sales volumes in the Republic of Ireland are already via dailies than in Great Britain where over half of volumes remain via reusables. It may be that maintaining the rate of transition to daily lenses becomes more difficult over time as the pool of reusable wearers to transition to dailies becomes lower and lower as a proportion of total contact lens wearers.

It seems then that with the contact lens market in the Republic of Ireland we have an inconsistency when compared to Great Britain. Overall sales levels, when factored for population size, are significantly behind those seen in Great Britain and suggest the potential for considerable total market growth in Ireland. However, within the existing market the Republic of Ireland is well ahead of the trend towards dailies having already transitioned in prior years a greater proportion of patients from reusables than seen in Great Britain.

Note: Data quoted covers mainland GB and Republic of Ireland Opticians Contact Lens Sales

Prepared by Paul York, senior account manager, Optics, paul.york@gfk.com, 020 7890 9513, gfk.