Since Brexit the UK’s economy was questioned on how it may perform with the majority of the UK choosing to leave the European Union at the end of Q2 2016. However, since then the economy has surprised people as Q3 2017 GDP growth is up +0.4% with similar growth seen in the previous two quarters earlier in the year (ONS, 2017).

On the other hand the results of GfK’s Consumer Confidence Barometer, which measures consumers’ perception on the economy over the next 12 months, indicate an increasing proportion of consumers think the economy will worsen. This indicates people are still uncertain about the future of the economy, raising questions of the consumer spending trend in the future.

Looking at total GB optical sales all product groups saw positive growth for September 2017 Moving Annual Total (MAT) compared to last year. GfK’s optic product groups (spectacle frames, sunglasses, contact lenses and contact lens care products) combined saw growth of +1.9% in the year.

Delving into each product group, the second largest segment by value sales is contact lenses displaying growth by +2.3%, showcasing that the segment is growing faster than the combined groups.

The trend in contact lenses is driven mainly by the dailies segment as more people continue to transition from reusable contact lenses. Indeed the reusable contact lens segment is down -5.0% compared to the daily segment growing by +7.4%.

However, despite reusable lenses recording negative growth contact lens care continues to grow at +1.3% with sunglasses also growing at the same rate compared to September 16 MAT. Finally the largest product group spectacle frames saw growth of +1.8% over the year.

With the spring and summer period being the peak for sunglasses sales, April and May saw an uplift of +2.8% and +3.1% respectively in sales value. However, June’s performance slowed the Q2 growth rate with a dip in sales of -5.2% over the month.

This resulted in Q2’s growth overall being tempered to +0.3% compared to Q2 2016 despite the strong performance over April and May. Digging deeper into the Q2 2017 performance, unit sales dropped by -3.9% while average price increased by +4.4% making the increasing average price paid the main driver of sunglasses value sales growth in Q2.

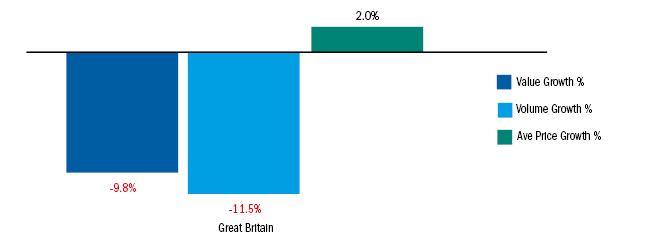

GB opticians sunglass market growth %

Conversely, Q3’s performance for sunglasses fell with value sales declining by -9.8% compared to Q3 2016. All three months in the quarter saw sales value decline versus the same period last year. August and September witnessed double digit decline in value sales of -10.7% and -11.6% respectively.

In addition, unit sales for Q3 declined by the higher rate of -11.5% further showing that Q3 2017 was a tough quarter for the sunglasses market. Delving into the influences of the poor performance in Q3 2017, weather is likely to be one of the major factors. The level of rainfall in particular was significantly higher this year than Q3 2016 with 9.5 more rainy days through the quarter (Met Office, 2017) – days which would not have lent themselves to high sunglass sales.

Note Data quoted covers mainland GB only

Prepared by Paul York, senior account manager, Optics, paul.york@gfk.com, 020 7890 9513, gfk.