Despite the looming economic threats of Brexit high street optical retailers can find reason for optimism after positive overall growth since the referendum vote.

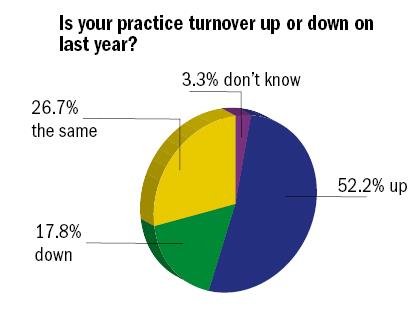

Around half of the 90 respondents in March’s Market Monitor survey say practice turnover is up from the same point last year, consistent with the previous Market Monitor in August 2017.

However, 18% say practice turnover is down, compared to 11% who gave the same response last summer. Just over a quarter reported unchanged practice turnover in March, which is up from 15% of respondents in the previous Market Monitor.

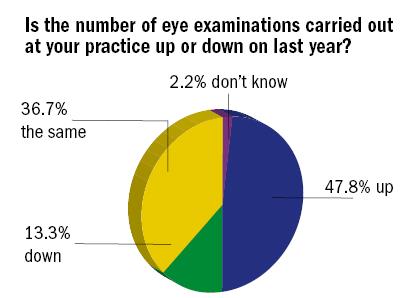

Meanwhile, around half of respondents say the number of eye exams being carried out in practice is up on the same point last year. But again, the number reporting the same number of year-on-year eye exams increased is higher, at 37%, than last year, when one in five practices said this metric was unchanged.

Therefore, Optician’s Spring 2018 Market Monitor shows signs of growth, but evidence of increasingly plateauing turnovers and eye exam figures among UK optical practices.

GOS crunch

As for NHS eye examinations, just over a quarter of practices report conducting more than three-quarters of eye exams under GOS. This represents a slight increase of 4% from those reporting such a high proportion of NHS eye exams from August last year.

The most common response for the proportion of NHS eye exams carried out in practice was between half and three-quarters, reported by 40% of respondents in March, and 34% in August last year.

With 2018 GOS fees once again frozen by the government – for a third successive year – practice owners in England continue to be frustrated by what is deemed a real-terms cut in key public service, being reimbursed £21.31 per eye exam. Nevertheless, Market Monitor shows 96% of practices still conduct at least a quarter of their eye exams through the health service, suggesting it remains a valuable source of income.

Another function of the Market Monitor survey is to gauge the average cost of a private eye exam. The most common figure, given by 42.7% of respondents, is a value of up to £25 – although this had reduced from 51% of those surveyed in August 2017.

A much higher proportion of respondents – 25% up from 14% last time around – offer private eye exams in the more expensive range of £36-£45.

Lenses and contact lenses

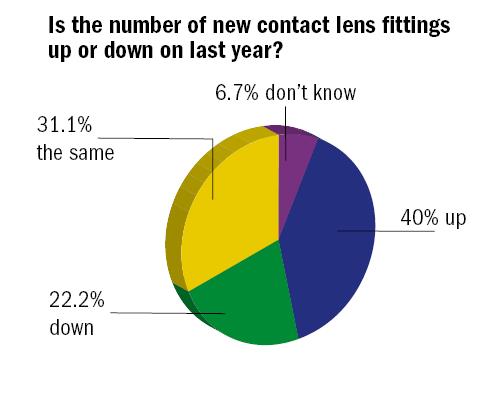

The March survey, consisting of 59% independents, 27% national optical chains and 11% regional chains with five or more outlets, also monitored sales volumes of different types of lenses and contact lens products.

Progressive lenses show most signs of growth, with 60% of practitioners dispensing more of these compared to last year. A similar trend transpired last August, but to a lesser extent when 50% of practices saw increased progressive lens sales.

Sales numbers for single vision lenses and photochromics, however, are showing weaker growth, with higher proportions of respondents stating that sales ‘stayed the same’ for each of these product categories in the past year.

Nevertheless, single vision lens sales are up at 43% of practices and photochromics up for 30% of respondents.

Bi/trifocal lenses are performing worst, according to Market Monitor, slumping in 47% of the practices surveyed. This figure has escalated since August when 33% of respondents reported lower sales of bi/trifocal spectacle lenses.

Contact lenses, meanwhile, demonstrate a similar level of variance from one product category to the next – with daily disposables taking the lion’s share of growth.

Among 90 responders in the latest Market Monitor, nearly half report increasing sales across in the daily disposable market. Forty-nine per cent say daily disposable silicone hydrogels are on the up and 46% are seeing higher sales of daily disposables as a whole. This represents an improvement from 43% and 45%, respectively, in the previous Market Monitor.

Monthly hydrogels, however, swing the other way with 48% of responders seeing sales down and just 10% managing to increase volumes. For monthly hydrogels though the figures are more encouraging – with 33% witnessing an upturn over 12 months and 21% saying sales are down.

Sales of silcone hydrogel extended wear contact lenses, however, struggled with 12% managing to increase sales of these products and 29% reporting a dip. Despite commercial developments in cosmetic contact lenses sales of these products are only increasing in 6% of practices, according to Market Monitor.

The results were consistent with latest Euromcontact figures showing that daily disposable contact lenses grew 7.6% across 11 leading global contact lens markets, higher than overall contact lens market growth of 4.3%.