At this year’s Optrafair lens makers were wooing practices with the promise of the latest high tech lens designs, great service and lower prices.

How so? The one thing that was missing was a big brand name. All of the unbranded lens suppliers Optician spoke to said practices were not getting the best from suppliers because they were failing to shop around and relying on top brands to offer the latest technology.

The latest Optician Market Monitor decided to test that assertion by asking practices about their buying habits. Alongside the regular questions covering turnover, eye exams and dispensing habits Optician also asked how practice manage and choose their suppliers.

The survey, conducted in the second half of June, found sentiment was generally better than this month last year with 54.9% reporting turnover up on a year ago. The balance was pretty evenly split between those seeing no change (24.2%) and those reporting turnover down (20.4%). The sentiment on the volume of eye examinations was not quite so rosy with 30.3% reporting volume down. Just 37.1% said eye exam numbers were up and 32.6% said they had remained stable.

Our sample of optometrists (54.4%), DOs (28.9%) and other practice staff were predominantly drawn from independent practice (81%) with most participating practices conducting between 75% and 100% of their eye exams on the NHS (40%). Practices conducting between half and three-quarters of their eye exams on the NHS made up 42.2% of the sample and practices conducting between zero and a quarter of their tests on the NHS made up 10% of the sample. The remaining 7.8% conduct between a quarter and a half of their tests on the NHS.

The price charged for an eye exam reflected this with the largest percentage (33.3%) in the £36 to £45 price band. The lower bands – zero to £25 (26.7%) and £26-£35 – made up 28.9% of the sample. At the other end of the scale 6.7% were charging more than £55 and 4.4% between £46 and £55.

When asked about the types of lenses dispensed some familiar trends emerged. The picture was steady on single vision lenses but for progressive lenses 62% reported an increase and just 10% a decrease with the remainder seeing no change. Bifocals were strongly down and photochromics were mixed. No change in dispensing of variable tint lenses was reported by 53% with an increase reported by 24% and a drop by 14%.

New contact lens fits provided a three-way split among practitioners. A fall was reported by 28.9% with 34.4% saying fits were up year on year and 36.7% saying new fits were static. When asked about the types of contact lenses dispensed daily disposables were the winners with 43% saying they were up in daily and silicone Hydrogel daily modalities. Monthly replacement daily wear SiHis also came out well with 31% reporting fits up. The biggest losers were cosmetic lenses and SiHi extended wear.

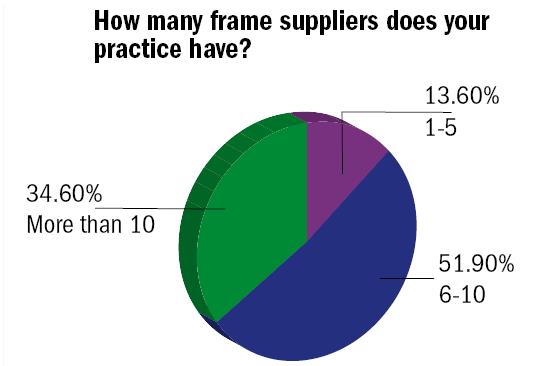

Our supplier focus looked at how these products are chosen and sourced. Optician started by asking practices how many frame suppliers they had. It is worth saying that about 10% of respondents did not answer this question suggesting they do not know. Of those that responded 34.6% said they had more than 10 frame suppliers, 51.9% said they had six to 10 and 13.6% had between one and five.

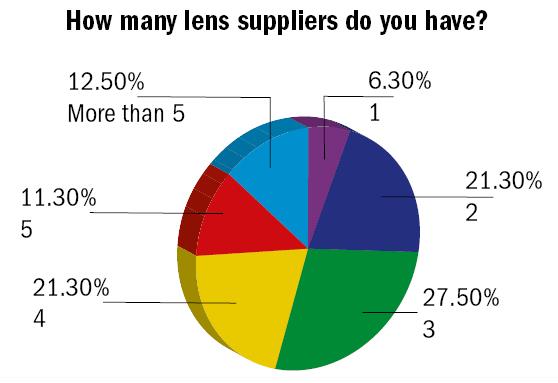

It was lens sector at Optrafair where non-branded suppliers were suggesting a switch from branded to unbranded product could maintain quality while reducing price. Here supply was much tighter with 6.3% having just one supplier, 21.3% had two, 27.5%, three, 21.3% four, 11.3% five and 12.5% more than five. Given that just 4% of practices in the sample were national chains and the same percentage regional chains it is clear there are independents with a small base of lens supply.

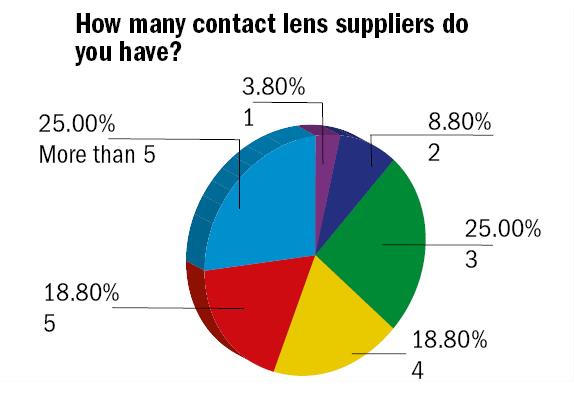

The supply of contact lenses was surprisingly spread with 25% saying they had more than five suppliers, the same percentage said they had three suppliers while 18.8% said they had both four or five. The remainder said they had two suppliers (8.8%) or just the one 3.8%.

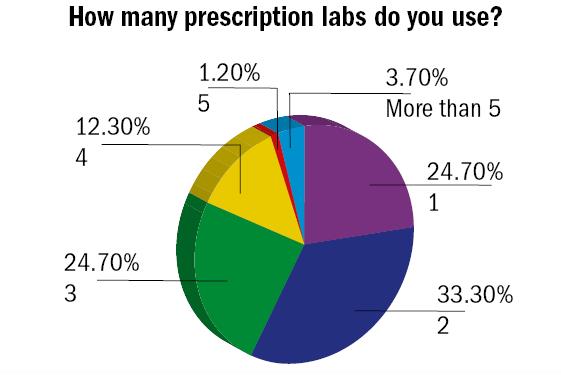

An area demonstrating very tight supply was prescription lab services. When asked 24.7% of practices said they used just one prescription lab and a third said they used two. Three labs were used by 24.7% and four by 12.3%. A tiny 1.2% used five or more than five (3.7%).

A more scientific picture emerged when practices were asked when they last systematically reviewed their supplier base. A healthy 56.8% said it had been reviewed in the last year and 11.1% said in the last month. Reviews had taken place in the last five years at 14.8% of practices while 17.3% any review had taken place more than five years ago.

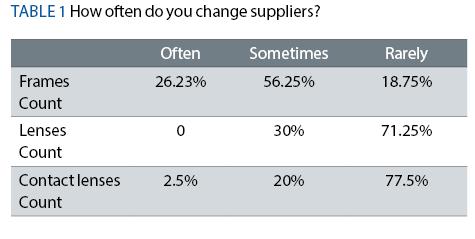

Within practices there is a clear definition between the treatment of different product types when it comes to choosing a supplier. Not surprisingly frames came in for the closest scrutiny with 26.25% saying they changed suppliers often, 56.25% saying sometimes and 18.75% saying rarely. Lenses and contact lens suppliers proved to be much stickier. Not a single practice said they changed their lens supplier often and just 2.5% of practices said the same for contact lenses. When it comes to lenses 30% said they changed supplier sometimes and 71.25% said rarely. The comparative figures for contact lens supplier changes were 20% and 77.5%.

The main catalyst for a review of supplier is when a problem occurs (29.6%) or there is a price increase (42.7%). New product launches prompt a review in 21% of practices and a planned regular review in 14.8%. Recommendation prompts a review in 7.4% of practices. Within the practice structure it is the owner (43.2%) who generally calls for a review of a supplier followed by the optometrist (22.2%), DO (17.3%) or manager (13.6%). A team decision to review is called in just 3.7% of the practices that responded.

Once a review and a decision to change a supplier has been made what criteria is used for a replacement? Quality is top of the selection criteria list for 54.3% of practices and service 19.8%. Brand is most significant for 7.4% and price for 9.9%. The remainder use a combination of these factors while the willingness to work with a small house practice was also cited by one respondent. The nature of suppliers has come under the spotlight of late but in our research 67.9% said they would not be concerned if a supplier was part of a multi-national corporation, 32.1% said that would be a problem for them.

When asked what sort of supplier they would favour 50.6% said suppliers who work exclusively with independent practices. A third were adamant that they chose suppliers on the products and services they offered. Local supply was important for 3.7% while choosing suppliers who do not deal with internet sellers was chosen by 12.3%.

There are clearly conflicts, from these final answers, in the choice of supplier made by many independent practices. There are many suppliers looking to win business from independent practices but incumbents appear to hold sway unless a problem occurs. Given the advances in technology a review of suppliers may be a worthwhile exercise.

If you would like to take part or have an idea for a topic on which to quiz Optician’s readers email chris.bennett@markallengroup.com.