The UK government triggered Article 50 to begin the formal process of leaving the European Union on March 29. Theresa May has been clear that ‘Brexit means Brexit’… but what could Brexit actually mean? At GfK we have looked into the potential impact on the GB Optics industry.

Firstly, a view of how consumers have reacted more generally. At GfK we track economic sentiment on a monthly basis via our Consumer Confidence Index. In the year running up to the referendum in June 2016 economic sentiment fell consistently and considerably, reaching a low point in July immediately following the referendum. At that point just 17% of people were of the opinion that the general economic situation was likely to improve over the coming year while 58% predicted it was likely to get worse.

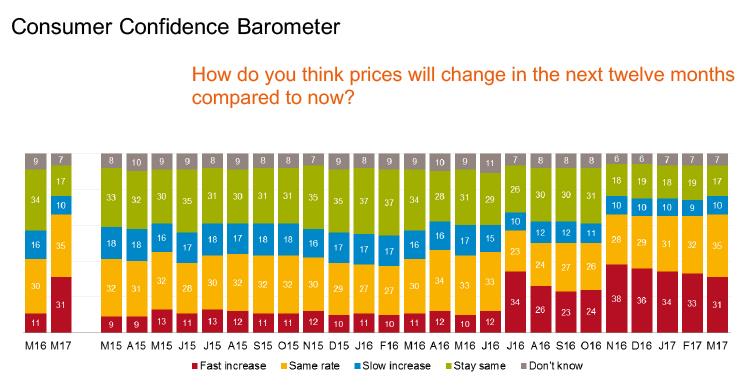

This measure has rebounded slightly and stabilised since then though the index remains at lows not seen since the 2008/09 credit crunch and the following recession. Perhaps the most significant specific change is the expectation of price inflation.

Prior to the referendum result around one in 10 respondents predicted a fast increase in prices while following the referendum this has increased to around one in three. It is also worth noting that inflation has increased since June 2016. Therefore, although the proportion of respondents predicting prices will increase at the same rate remains largely consistent the same rate has in itself increased.

With economic sentiment at its lowest point since the financial crisis let us look back and reflect on what impact this had on the GB Optics market.

Firstly, the spectacle frames market, the largest by revenues of the optical product groups tracked by GfK, declined significantly. Annual sales value at high street opticians declined by over £100m between 2008 and 2011.

This was due to a combination of both lower average prices and falling absolute volumes sold. Average prices fell as customers looked to economise with both the independents channel and branded sales falling as a proportion of total volumes sold.

The volumes bought declined significantly with around one million fewer units sold in 2011 compared to 2008 as customers delayed or declined altogether to make spectacle purchases.

Contact lenses continued to grow revenues over this time, albeit at a slightly slower rate than seen currently, with an average of an additional £17m in year on year revenues between 2008 and 2012. By comparison between 2012 and 2016 contact lenses revenues grew on average by £22.75m per year.

What impact did this have on the industry? Between 2009 and 2011 around 600 GB opticians closed their doors – primarily impacting the independent channel.

While it is true that there was significant consolidation among retailers over this period, which would have led to some doors closing, the decline in numbers seen was far beyond the result of takeovers and must be put down to pressure on practice revenues.

Back to the present and how does the situation look? Currently we see sales at GB opticians growing in value for both spectacle frames (+5.4%) and contact lenses (+4.6%) in Q1 2017. However, both product groups have seen volume sales decline over the past year with value growth due solely to average price increases. Volume declines could be an indication that we are again potentially entering a period of downward pressure and so converting sales opportunities will be all the more crucial in order for practices to succeed.

So far this paints a gloomy picture. However, we should be cautious and recognise that we do not know exactly how Brexit will impact the industry, or the UK generally for that matter. And, though we currently see consumer confidence at levels not seen since the financial crisis this is a measure simply of economic sentiment.

In the wake of the financial crisis a decade ago, alongside declines in sentiment, economic measures such as employment, GDP and average wage growth turned negative, impacting people directly. That said, this could provide a guide as to the potential worst case scenario should Brexit go seriously awry.

Note Data quoted covers England, Wales and Scotland

Prepared by Paul York, senior account manager, Optics, paul.york@gfk.com, 020 7890 9513, gfk.