The UK is the number one market for sales of contact lenses and delivers over 37 per cent of the total annual value of the top five European countries.

The UK is the number one market for sales of contact lenses and delivers over 37 per cent of the total annual value of the top five European countries.

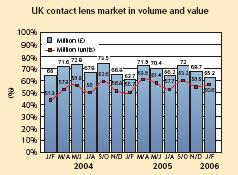

Despite being the European contact lens capital, over the past year the UK has witnessed a different performance to other European countries. The growth in consumers choosing frequent replacement lenses has and continues to be beneficial to the market growth in terms of volume. In 2005 the volume of the contact lens market grew by 5 per cent to record sales of over 361 million lenses. However, due to a number of factors which will be explored later, the market witnessed a decline in overall value.

Register now to continue reading

Thank you for visiting Optician Online. Register now to access up to 10 news and opinion articles a month.

Register

Already have an account? Sign in here